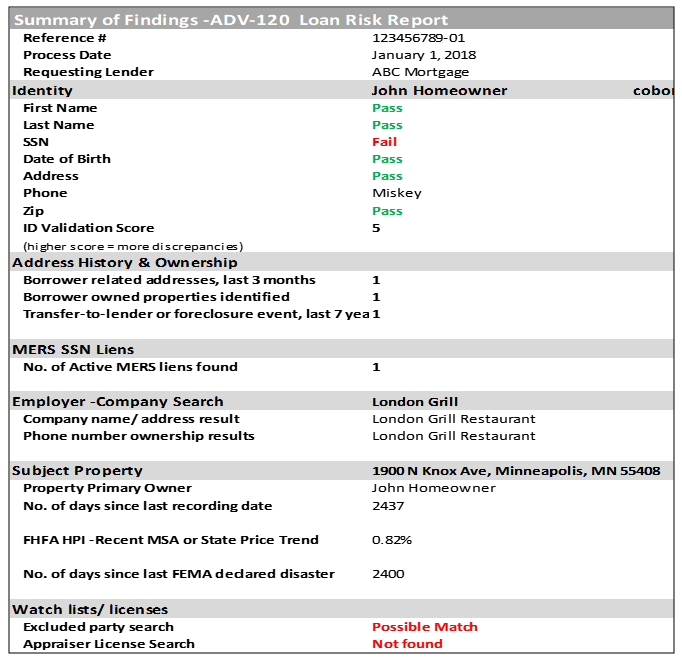

The ADV (Application Data Verification) Report is a single comprehensive report identifying fraud risk factors within the mortgage loan application. Our system parses the loan file and verifies key loan data and returns a concise report highlighting discrepancies between the loan application data and public records. The report covers the key verification elements required by secondary market investors including Fannie Mae LQI and is approved by: Texas Capital Bank, CitiMortgage, Chase, Chase Rural, Stonegate, Trustmark, Guardian, Pacific Union, Nationstar, Republic Bank & Trust, Stearns, First Guaranty, Planet Home Lending, among others.

The Next Generation in Fraud Risk Reporting

ADV Report Reduces Risks

- ADV is a comprehensive loan fraud risk report

- ADV is approved by investors

- Fully integrated into popular loan origination systems

- ADV can trigger underwriting conditions based on risk factors

- Highly configurable verification rules and content

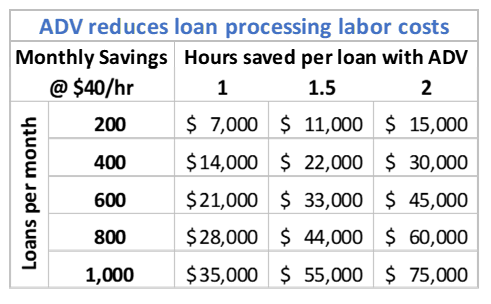

ADV Saves 1 to 2 Hours of Loan Processing Time

- Reduces review time and errors with an easy to read Pass/ Fail result against a consistent list of 3 dozen tests

- Intuitive layout eliminates need for specialized user training

- Automatically identifies miskey, to prevent false alerts

- Automatically tests alternative phone number, when primary phone is an unlisted cell phone number

- Detailed report chapters follow summary of findings; so logical flow of detailed results

ADV Features One-Click to Eliminate Hours of Loan Processing Time

- Have our fraud specialists quickly research all alerts, update the report and add journal notes and supporting docs

- ADV report returned within 1 hour

- Lowers your loan processing costs

ADV Includes Tools For Your Team to Quickly Research Alerts

- Integrated tools to research alerts

- Integrated messaging with our fraud specialists

- Integrated feature to change an alert to cleared-by-lender; this instantly updates the ADV report and the change log, and adds journal notes and supporting docs to ADV

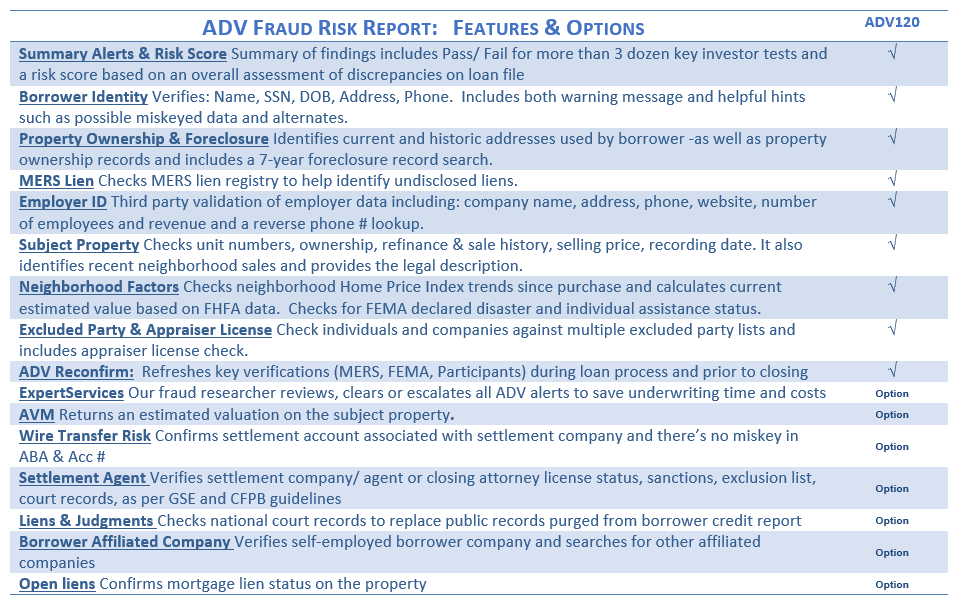

MFI ADV Fraud Risk Report Features

Comprehensive and Investor Approved

The ADV ExpertService option diverts the ADV report to one of our fraud specialists who quickly researches all alerts and clears false alerts, documents the research and updates, or escalates the alert. The updated ADV report is returned within 1 hour eliminating hours of loan processing and underwriter effort, helping lenders improve profitability.

Most lenders use a consolidated fraud risk report on all loans to reduce risks and ensure compliance. The ADV report is the next generation in fraud risk reports, with a focus on improving lender productivity. Our clients report saving 1 to 2 hours per loan -for an underwriter that can increase productivity by 10% to 15%. This adds up to savings for the lender. For example, a lender processing 400 loans per month, the savings can add up to $30,000 per month.